|

The Better Business Bureau of Metro New York has issued a warning to consumers about a timeshare advertising business using the name "All Seasons Timeshares", which has been the subject of many consumer complaints. Follows is an excerpt from the warning:

"...All Seasons Timeshares reneged on the “100% Money Back Guarantee” for fees charged for a timeshare resale listing. Consumers reported signing contracts with All Seasons Timeshares to list their timeshares on the company’s website and to hire the company to help broker the sales, allegedly paying an upfront fee ranging from $300 - $1000. According to the complainants, the contracts they signed stipulated that if All Seasons Timeshares was unable to sell their timeshares in the allotted timeframe, All Seasons Timeshares would refund the entire listing fee. Consumers say the terms of the guarantee required them to fax the company on the same day that the contract expired and request the money back. In complaints, consumers state that their timeshares were not sold by the end of the guarantee period and they faxed the required notification to All Seasons Timeshares. The promised refunds were not issued and consumers say the company representatives stopped returning calls and/or emails. Mailed complaint notifications issued by the BBB came back as undeliverable by USPS and the website for All Seasons Timeshares was eventually shut down. BBB dispute resolution representatives left messages on the phone number for All Seasons Timeshares that were not returned. .." More good news in the continuing fight against telemarketing fraud targeting timeshare owners!

Doris Heliin was sentenced to four and a half years in prison for her part in a telemarketing scheme that targeting timeshare owners and defrauded more than a million dollars from consumers with false promises of timeshare resales. She was also ordered to pay more than $500,000 in restitution to victims of the scam. Co-defendent Joseph Heinz, who also pleaded guilty, was also sentenced to more than a year in prison and ordered to pay more than $70,000. in restitution. The boiler room scheme used several aliases including Smart Choice Vacations, TMI Enterprises and Divine Vacations Group. Authorities clam that more than two hundred and fifty timeshare owners lost a total of $1.1 million after they were duped into sending payments for fake closing costs on timeshare sales that never materialized. Authorities have charged a father and son team with taking part in a telemarketing scheme to defraud timeshare owners. Ronald and Michael Muise are facing charges of wire and mail fraud through a telemarketing business under the name "The Jariv Company". Other employees are also facing charges.

The Muises are accused of cold calling timeshare owners with the promise of a buyer for their unwanted vacation ownership property. The timeshare owners were coerced into paying large upfront fees, and were then unable to obtain a refund when the promised sale did not occur. Authorities believe the scheme defrauded consumers of more than seven million dollars over a five year period. Read more by clicking HERE. Another reader has submitted a timeshare scam report detailing a fraudulent timeshare resale transaction wherein the victim claims to have lost more than $3,000. in fake closing costs.

"... We were contacted with a sales price of $28,000.00 for our 1 br 1 bt timeshare condo. We have been approached once for $1,818.oo for closing costs. We were approached again for another $1,500.00 for additional costs. We sent both of these amounts. Now they have asked for an additional $1,500.00, which we have not sent. The man we talked to first was Jerry Clark and the one this time was John Fernandez. phone # of 1-619-906-7283..." This another example of a common telemarketing scam where timeshare owners are enticed to send a large upfront fee by bank wire with the promise of an unrealistic sale price. Timeshare owners can protect themselves by simply taking the time to perform threee simple steps before paying any type of advance fee to sell their timeshare: 1) Call their timeshare resort for a referral to a legitimate closing agency or attorney, to obtain a realistic estimate of closing costs and transfer fees. In this particular case, the resort in question is located in Tennessee, and the actual cost for deed prep and recording through the attorney owned timeshare closing agency PCS Title would have only been $115. 2) Look for current timeshare sellers who are advertising the same resort for sale to get a rough idea of comparables on the market. For this particular resort, there are currently six ads showing on the timeshare classified website MyResortNetwork.com which range in asking price from $1,000 to $2,550. These are asking prices- which means that they have not yet sold! An owner can simply ask themselves if the offer they received is reasonable. 3) If a timeshare owner has completed the two steps above and still believes the purchase offer is legitimate, the final step is always a sure way to weed out the con artists. The timeshare owner can simply offer to pay all the closing costs to a respected closing agency the timeshare owner chooses. This closing agency will then act as the escrow agent for the sale, ensuring that both parties are protected throughout the transaction. It's unfortunate that this type of telemarketing fraud occurs, but these few simple steps will protect a timeshare owner from the majority of timeshare resale fraud. A reader has submitted what he believes to be a timeshare rental scam perpetrated by a business using the name Julius M Vacation Timeshare Rentals, who offered vacation rentals at Casa del Mar Beach Resort in Aruba. The reader claims that he paid in full for reservations that have not been provided, and has been unable to obtain a refund. Follows is the warning sent in by the reader.

..."Julius M. Vacation Rentals ( Julius Martins) rented us 4 weeks in Aruba for timeshare rentals, and never supplied final confirmations for any of them, In fact he kept asking for more money just to finish the bookings, so he says. He is not willing to refund nothing and is a complete a rip off!"... The reader also sent in a copy of the executed rental agreement. The document was professional in appearance, but did have a few flags that could have been a cause for concern: 1) The contract did not provide any specific information about the landlord other than the name Julius Martins. 2) The contract requested direct payment by electonic wire. The only way a tenant can truly protect themselves from possible fraud is to insist on an independent escrow service. When an escrow company is used, the payment is held and protected by the third party service until after the tenant checks into the condo. If the landlord refuses to accept escrow, take your business elsewhere. Many consumers mistakenly believe that payment by a transfer service such as PayPal, or payment by credit card provides protection to the renter. This is also false! PayPal does not provide buyer protection for any type of real estate transaction, and vacation rentals are classified as real estate. Also, for many rentals- the ocupancy date can easily exceed the window of opportunity to file a dispute of payment. Many credit card merchants will only allow a sixty or ninety day window to dispute payment. After that time frame, any requested dispute is automatically denied. A reader has submitted what he believes to be a timeshare rental scam perpetrated by a business using the name Julius M Vacation Timeshare Rentals, who offered vacation rentals at Casa del Mar Beach Resort in Aruba. The reader claims that he paid in full for reservations that have not been provided, and has been unable to obtain a refund. Follows is the warning sent in by the reader.

..."Julius M. Vacation Rentals ( Julius Martins) rented us 4 weeks in Aruba for timeshare rentals, and never supplied final confirmations for any of them, In fact he kept asking for more money just to finish the bookings, so he says. He is not willing to refund nothing and is a complete a rip off!"... The reader also sent in a copy of the executed rental agreement. The document was professional in appearance, but did have a few flags that could have been a cause for concern: 1) The contract did not provide any specific information about the landlord other than the name Julius Martins. 2) The contract requested direct payment by electonic wire. The only way a tenant can truly protect themselves from possible fraud is to insist on an independent escrow service. When an escrow company is used, the payment is held and protected by the third party service until after the tenant checks into the condo. If the landlord refuses to accept escrow, take your business elsewhere. Many consumers mistakenly believe that payment by a transfer service such as PayPal, or payment by credit card provides protection to the renter. This is also false! PayPal does not provide buyer protection for any type of real estate transaction, and vacation rentals are classified as real estate. Also, for many rentals- the ocupancy date can easily exceed the window of opportunity to file a dispute of payment. Many credit card merchants will only allow a sixty or ninety day window to dispute payment. After that time frame, any requested dispute is automatically denied. After a long wait for many timeshare owners who believe they were victims of a timeshare scam perpetrated by employees of the Vacation Ownership Group, the jury is expected to begin final deliberations next week. The jury is charged with deciding whether a group of individuals knowingly orchestrated a multimillion-dollar time-share mortgage release scam. An article on Philly.com offers new details in the trial proceeding, including a note intercepted by deputies urging the company owners, Adam and Ashley Lacerda, to flee the country to avoid prosecution. Follows is an excerpt from the article:

"...Resnick, in custody on charges of domestic violence, passed a note to Ashley Lacerda, who was detained due to evidence she tried to contact a witness. The note, which was intercepted by U.S. Marshals and read into the record out of the presence of the jury, urged Ashley to tell her husband, who was not in custody, to flee the country. 'Go to Bermuda' "Don't risk another day in jail - Go to Bermuda - small private plane - from there Cuba or Venezuela - ask for Asylum - cause mistrial - case falls apart without him here - saves us all," the note read. The government did not seek additional charges against Resnick but motioned for Adam Lacerda to be detained, calling him a potential flight risk. Judge Noel L. Hillman granted the motion and revoked Lacerda's bail. On Thursday, the government finished its summation, followed by five hours of closing arguments from the five defense attorneys. Central to the case is testimony from seven former VO employees who pleaded guilty to the fraud and directly implicated the defendants on the stand. Defense attorneys have described those seven as liars, criminals, and "junkies" (several admitted to taking five to 10 oxycodine pills a day and drinking large quantities of alcohol while on the job)...." Please read the full article at http://www.philly.com/philly/news/local/20130830_5_await_verdict_in_Camden_court_in_alleged_time-share_scam.html#38I7gr96mcI357MY.99 Hopefully, jury deliberation and sentencing will proceed quickly and provide ample punishment if these individuals are found guilty. This trial, even though it appears to have taken some bizarre turns, can serve as a fantastic example to victims of timeshare fraud that reporting these crimes does make a difference! Always take the time to report consumer fraud- it's the only way to stop these con artists! A reader has submitted a possible timeshare alert complaining that a timeshare disposal company using the names Right Choice Transfer and/or Pacific Property Transfer, took a large upfront fee in excess of $4,000. but did not transfer the timeshare ownership out of her name, and then refused to refund her payment. She also stated that her credit card company refused her chargeback request because it was too late for her to file based on the date the amount was charged by the company.

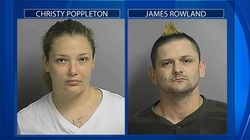

The dispute deadline for many credit cards is something that many consumers don't fully understand. Many credit card companies will automatically decline any payment disputes if the charge is more than ninety days old. This deadline makes it extremely difficult for timeshare owners to protect themselves from fraudulent timeshare transfer companies, simply because the promised transfers are normally not expected to close during that ninety day period. If the transfer company does not perform as promised, there is often little to no recourse for consumers. Follows is the possible scam alert submitted by the reader...... "... The name of the transfer company is: Pacific Transfer 2241 West 190th Street Suite 200A Torrance, CA 90504 Phone: 888-794-7612 Agents handling transfer: Nicole Heater Second Agent: Marinelle Mascardo Money given to company: $4,291.00 Transaction date: 11/23/12 Description: Right Choice Transfer Torrance, CA I listened to a phone presentation and was told if the transfer of the timeshare did not go thru I would get my money back. I paid $4,291 on 11/23/2012 I kept calling to see what the hold up was. I did everything they wanted me to do but they did not do what they promised. I asked for my money back 7/2013 and was told no. I called my charge card company and they tried to talk to them but told me because the transaction happened last year they could not help me. Do not do business with this company.... Linda S" It is always important for readers to understand that a submitted scam alert does not provide any proof of fraud, but that shared information such as this can be of great benefit to consumers performing their own due diligence before paying any type of fee to a timeshare related company. Consumers should also check for recent consumer complaints with the Better Business Bureau, and also may want to avoid companies that appear to frequently change business names. There appear to have been numerous affiliated business names used at this same address including Gray Wolf Transfers, Transfer America, Transfer on the Spot, Timeshare Cure, and others.  A new report in the Orlando Sentinel claims that a Spinnaker Resorts telemarketer and her boyfriend have been arrested and charged with two counts of fraudulent use of a credit card, according to Osceola County sheriff's investigators. Osceola detectives say dozens of timeshare customers may have been victimized by a call center telemarketer who used their credit card numbers for commissary deposits to county jail inmates, including her boyfriend. According to an affidavit, corrections officials were tipped off to the fraud anonymously, and soon discovered that several inmates had recieved deposits from a "Bob Smith," from credit cards that didn't match that name. Detectives later reviewed a phone call from inmate James Robert Rowland, 38, to his girlfriend, 32-year-old Christy Meleah Poppleton, in which he directed her to deposit money into his and another inmate's accounts, the affidavit states. The fellow inmate confirmed Rowland approached him about having Poppleton make a deposit, the affidavit states, explaining he got to use $12 of every $100 Poppleton deposited in his account, and Rowland got the rest. Several cardholders associated with the "Bob Smith" deposits confirmed they were fraudulent, and told detectives they had recently made payments to Spinnaker Resorts, where Poppleton worked, the affidavit says. The couple face charges of fraudulent credit card use, and additional charges are expected. Records show Rowland was sentenced to eight years in prison on burglary charges last month, as the fraud case was developing. According to the affidavit, Poppleton was on probation for giving false information to a pawn broker before her arrest, and her probation officer confirmed it was Poppleton's voice recorded on the jail phone call with Rowland. Poppleton's LinkedIn profile show her to also be a past employee of both Summer Bay Orlando and Starwood Vacation Ownership. The South Lake Tahoe Police Department says fake postings on legitimate vacation rental sites are advertising properties in South Lake Tahoe. People interested the properties are sent a rental agreement by email and are asked to asked to wire money to an account. Victims believe they've made a reservation, but when discover the arrangement was a scam when they arrive.

This type of rental scam is common in many respected classified venues, and simply involves a con artist creating a fake ad posting- often copying the information and details from a legitimate owner or broker advertisement. They offer these rentals are drastically reduced prices to garner interest, then send out a payment demand requesting money order, wire transfer, or payment via an online transfer service such as PayPal. When the renter arrives, they realize they do not have a valid reservation and are unable to recover their payment. While many consumers believe that a service such as PayPal can protect them from scams, they often are very surprised to discover that PayPal does not provide buyer protection on a real estate transaction. And many credit cards also restrict chargebacks to a specific period of time, often 90 days from the date payment was made. Often, the only way for a renter to truly protect their family from vacation rental fraud is to insist on using a respected third party escrow service who will hold and protect the payment until after check in- ensuring the tenant's money is protected until after they have checked in to the condo. Vacation-Times.org is proud to be listed as a trusted partner of the online escrow service DepositGuard.com. DepositGuard offers an inexpensive vacation rental escrow service for both landlords or tenants, and can give you the peace of mind knowing that your next vacation rental is a safe and secure transaction. |

Past Scam Alerts:

All

|

RSS Feed

RSS Feed